NetEnt Casinos

A cryptocurrency faucet is a platform or website offering small amounts of crypto in exchange for completing tasks like watching ads or solving captchas. Faucets are one of the easiest ways to earn free crypto, as they don’t require initial investment or specific skills. NetEnt Casinos Users can typically claim rewards once per hour or per day. However, caution is advised to avoid potential scams associated with certain faucet platforms.

However, it is important for users to take precautions when participating in these reward programs to avoid scams and fraudulent schemes. It is advisable to research and choose well-established platforms with positive user reviews and transparent operations. Users should also be cautious of any requests for personal information or financial details and ensure they use secure connections and reputable platforms.

• Users engage in cryptocurrency education lessons that include text and images. After each lesson, they answer a question to earn crypto rewards from a specific cryptocurrency project. Typically, rewards are small denominations of cryptocurrency, usually between $1 and $10.

Based in Canada, CoinSmart offers new users a sweet deal—15 CAD worth of Bitcoin when you sign up and verify your account. You can boost your Bitcoin stash even more by referring friends, completing challenges, and diving into promotions. CoinSmart supports over 15 cryptocurrencies, including Bitcoin, Ethereum, and Litecoin.

It’s important to regularly check Coinbase’s policies and updates, as these criteria and the availability of the Earn program can change based on regulatory developments and Coinbase’s internal decisions.

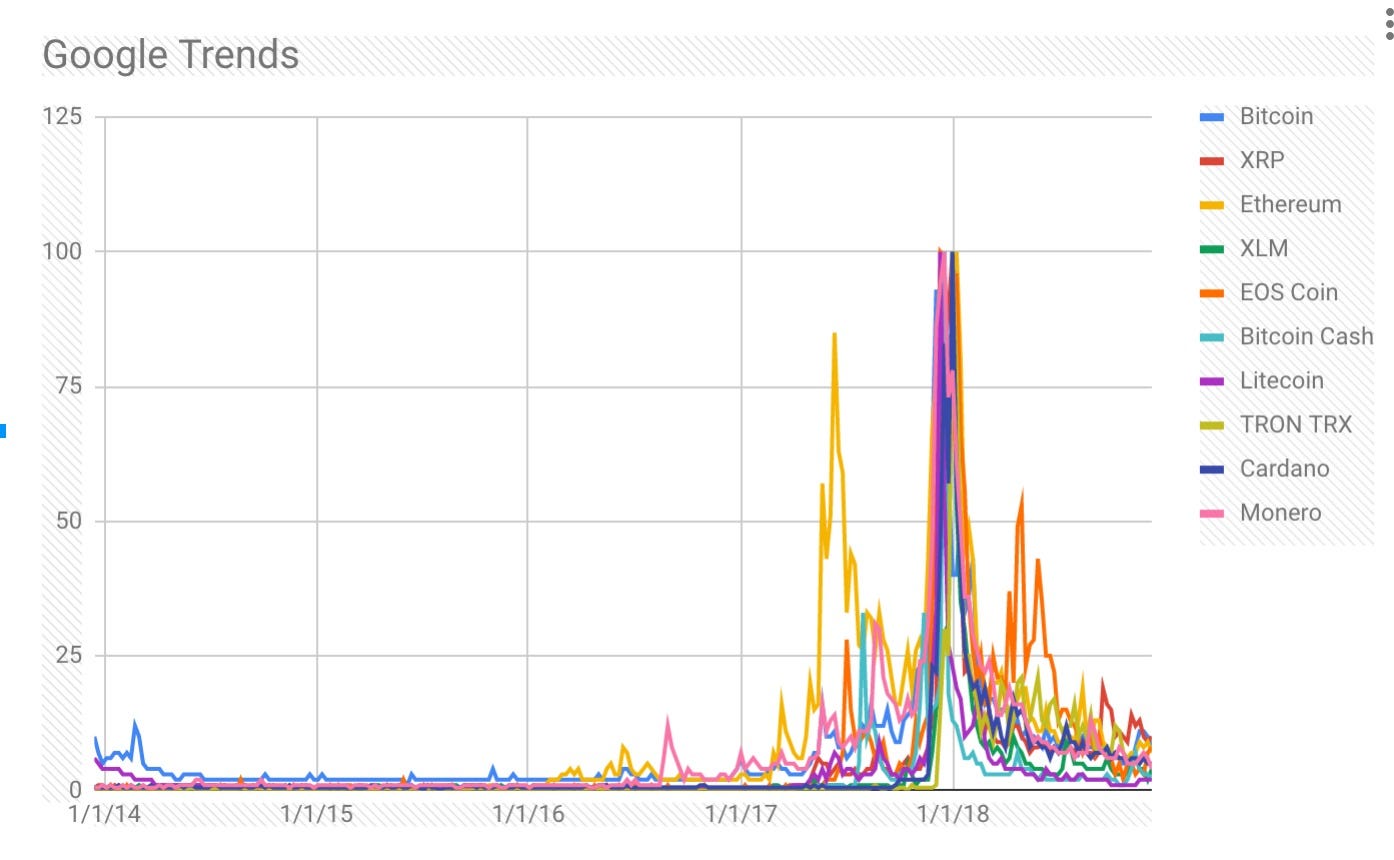

Cryptocurrency price

De gegevens op CoinMarketCap worden elke paar seconden bijgewerkt, wat betekent dat het mogelijk is om op elk moment en vanuit elke plaats ter wereld de waarde van uw investeringen en activa te controleren. We kijken ernaar uit u regelmatig te zien!

Bitcoin’s total supply is limited by its software and will never exceed 21,000,000 coins. New coins are created during the process known as “mining”: as transactions are relayed across the network, they get picked up by miners and packaged into blocks, which are in turn protected by complex cryptographic calculations.

De gegevens op CoinMarketCap worden elke paar seconden bijgewerkt, wat betekent dat het mogelijk is om op elk moment en vanuit elke plaats ter wereld de waarde van uw investeringen en activa te controleren. We kijken ernaar uit u regelmatig te zien!

Bitcoin’s total supply is limited by its software and will never exceed 21,000,000 coins. New coins are created during the process known as “mining”: as transactions are relayed across the network, they get picked up by miners and packaged into blocks, which are in turn protected by complex cryptographic calculations.

In the August 2021 Ethereum network upgrade, the London hard fork contained the Ethereum Improvement Protocol, EIP-1559. Instead of the first-price auction mechanism where the highest bidder wins, EIP-1559 introduces a “base fee” for transactions to be included in the next block. Users that want to have their transaction prioritized can pay a “tip” or “priority fee” to miners. As the base fee adjusts dynamically with transaction activity, this reduces the volatility of Ethereum gas fees, although it does not reduce the price, which is notoriously high during peak congestion on the network.

The news has produced commentary from tech entrepreneurs to environmental activists to political leaders alike. In May 2021, Tesla CEO Elon Musk even stated that Tesla would no longer accept the cryptocurrency as payment, due to his concern regarding its environmental footprint. Though many of these individuals have condemned this issue and move on, some have prompted solutions: how do we make Bitcoin more energy efficient? Others have simply taken the defensive position, stating that the Bitcoin energy problem may be exaggerated.

Cryptocurrency reddit

By accepting all cookies, you agree to our use of cookies to deliver and maintain our services and site, improve the quality of Reddit, personalize Reddit content and advertising, and measure the effectiveness of advertising.

If I could say that I own a one-of-a-kind digital stamped version of Carlos Matos in his absolute prime, I’d likely not have to worry about money for the rest of my life… In reality, it’s widely speculated that because NFT’s are extremely easy to create – if you’ve made it this far, don’t give people hints, play it cool in the comments – and can be purchased for any amount of money, the likelihood that they’re being used for purposes such as money laundering is extremely likely considering how increasingly easy it is for the average person to get involved.

Step 3: Once you have built up your passive investment portfolio, you can look at active investing. It is crucial to have the first 2 points mentioned above so that you do not crash and burn. Again, start small, allocate maximum 10% of what you are willing to risk into active investing. You can start looking into ICOs, new coins and even crypto interest earning platforms to earn yield on your crypto. For diversification sake, look into CeFi solutions like interest-earning platforms like Hodlnaut, Nexo, Celsius, Anchor Protocol, YouHodler Avalanche. Or owning a masternode by staking 32 ETH. You can even look into doing leverage trading with your crypto. These are all middle to high-risk options and you must be willing to lose them in case shit hits the fan. My strategy is to save up for 6 months, and take for e.g, 5k worth to invest with BTC in let’s say into an interest-earning platform and watch as it does its thing while earning interest! It doesn’t matter if I lose this because I already built a foundation in step 1 and 2!

By accepting all cookies, you agree to our use of cookies to deliver and maintain our services and site, improve the quality of Reddit, personalize Reddit content and advertising, and measure the effectiveness of advertising.

If I could say that I own a one-of-a-kind digital stamped version of Carlos Matos in his absolute prime, I’d likely not have to worry about money for the rest of my life… In reality, it’s widely speculated that because NFT’s are extremely easy to create – if you’ve made it this far, don’t give people hints, play it cool in the comments – and can be purchased for any amount of money, the likelihood that they’re being used for purposes such as money laundering is extremely likely considering how increasingly easy it is for the average person to get involved.

Step 3: Once you have built up your passive investment portfolio, you can look at active investing. It is crucial to have the first 2 points mentioned above so that you do not crash and burn. Again, start small, allocate maximum 10% of what you are willing to risk into active investing. You can start looking into ICOs, new coins and even crypto interest earning platforms to earn yield on your crypto. For diversification sake, look into CeFi solutions like interest-earning platforms like Hodlnaut, Nexo, Celsius, Anchor Protocol, YouHodler Avalanche. Or owning a masternode by staking 32 ETH. You can even look into doing leverage trading with your crypto. These are all middle to high-risk options and you must be willing to lose them in case shit hits the fan. My strategy is to save up for 6 months, and take for e.g, 5k worth to invest with BTC in let’s say into an interest-earning platform and watch as it does its thing while earning interest! It doesn’t matter if I lose this because I already built a foundation in step 1 and 2!